Hawaiʻi’s two-tier tax system: How the rich use a glaring loophole to pay less

While teachers, nurses and service workers pay income tax on every dollar they earn, the wealthy can shield a large portion of their profits thanks to a special tax break on capital gains.

A path to more affordable housing: Rethinking county rules

County governments control what gets built through zoning, and through lengthy discretionary approvals. Both levers have historically been used to restrict supply.

Transformative change meets budget realities—a central lawmaking tension plays out in two new reports

Policy in Perspective 2025 and the Hawaiʻi Budget Primer FY2025–26 provide a compelling—and sometimes sobering—look at how Hawaiʻi invests, and often under-invests, in its communities.

Can Hawaiʻi afford to cut the grocery tax?

Any proposal to reduce or remove the GET on food must be paired with a credible plan for replacing the revenue. It’s a challenge, but also an opportunity to build a fairer and more sustainable system.

We need to talk about inclusionary zoning

Inclusionary Zoning is a band-aid solution to a crisis that demands major surgery. It’s time to confront why this policy hasn’t worked—and what we should do instead.

Incoming federal tax cuts will heavily favor Hawaiʻi’s wealthiest residents

The State of Hawaiʻi has an obligation to shore up its revenue through tax policies that make the wealthiest among us pay their fair share.

How looming Federal cuts could impact housing in Hawaiʻi

If enacted, these cuts would gut rental assistance, eliminate key affordable housing development programs and slash funding for homelessness services.

Hawaiʻi’s 2025 legislature focused on raising tax revenue to prepare for federal cuts

Assessing a proper tax rate on corporations and the wealthy will be necessary to produce a budget that can fund critical safety net programs and investments in our future.

Transformative housing bills went nowhere this legislative session, but small wins keep hope alive

With federal cuts looming and home prices still climbing, the stakes have never been higher. One thing is clear: Hawaiʻi’s families can’t afford another session of half-measures.

How to fix Honolulu’s Empty Homes Tax proposal

A newly released report commissioned by the county council demonstrates the need to align Honolulu’s policy proposal with demonstrated best practices.

Reimagining our streets for health, fun and community

HB1260 would support the creation of a Summer Street Pilot Program, designed to temporarily transform car-congested roadways into vibrant spaces for outdoor fun and social interaction.

Proposed Trump tax cuts will overwhelmingly benefit the top 1 percent

As millions of Americans file their taxes this April, both the U.S. House and Senate have passed budget resolutions that open the pathway for a massive tax giveaway for the wealthiest people in the country.

Hawaiʻi should close tax loopholes for multinational corporations

Multinational corporations make huge profits from the business activity they conduct in Hawaiʻi, while dodging the taxes they should be paying to support our state.

Why is SNAP failing Hawaiʻi residents?

It’s time for the state to invest in a more resilient, independent social safety net system that can keep working families going regardless of chaos at the federal level.

Expand the state’s e-bike rebate program to improve mobility options

Now is the time for the state to expand the electric bike and moped rebate program to lower household transportation costs, reduce vehicle costs, and increase resident’s physical activity.

Congress’ budget blueprint leaves Hawaiʻi’s working families behind

In effect, the budget blueprint aims to take food out of the mouths of hungry keiki, so that billionaires can pad their pockets even more on the way to the bank.

Tax credits are more necessary than ever in 2025

Hawaiʻi’s families need urgent help to deal with the high cost of living. This is especially true for parents, who have to balance the cost of child care, rent, and food every month.

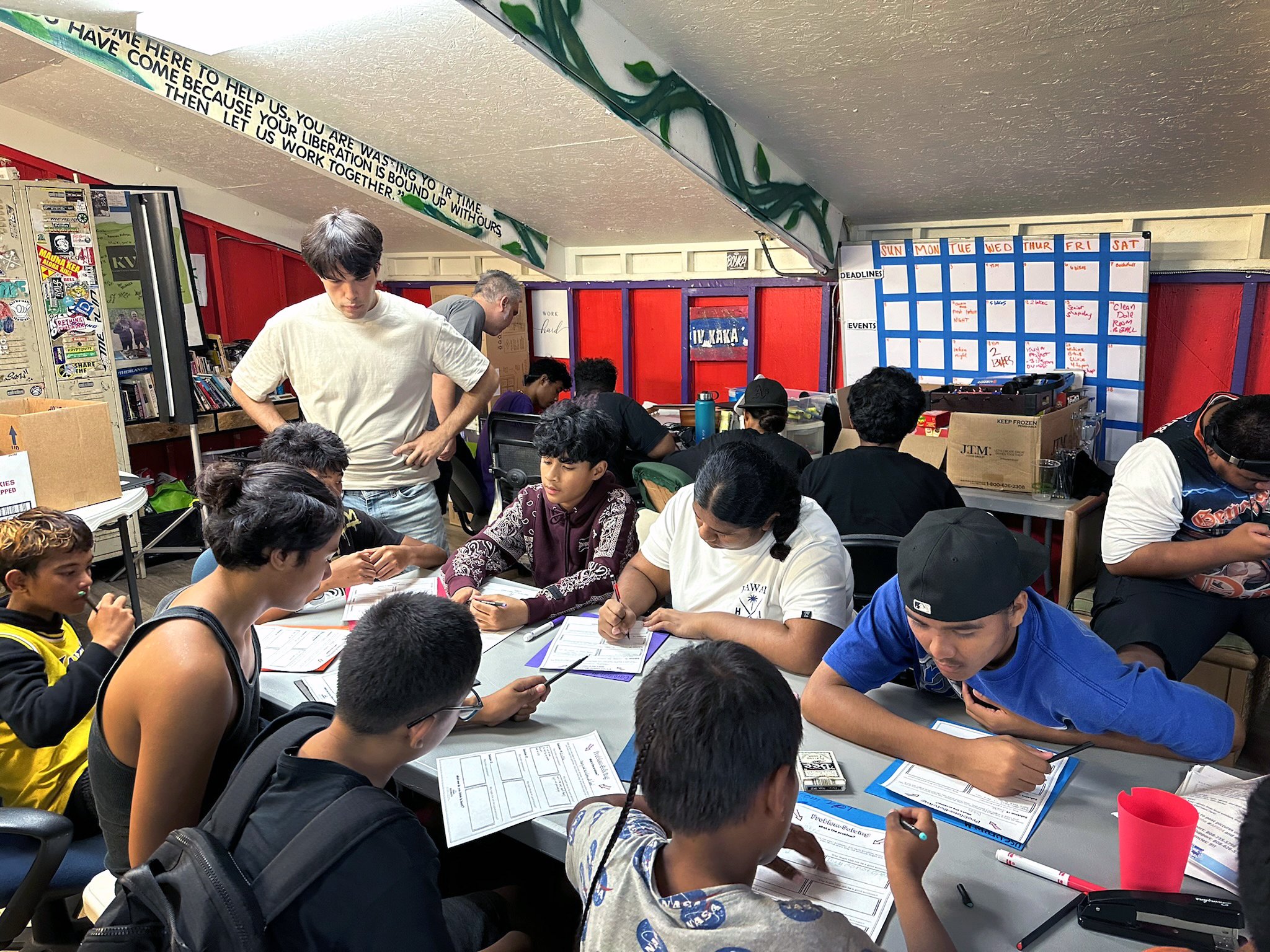

Empowering Kalihi’s youth leaders through community organizing and policy advocacy training

While people in power sometimes hand wave the voice of youth in policy conversations, our partnership with KVIBE is a reminder that young people can and should be integral components of the decision-making process.

How a second Trump presidency could impact the pocket books of Hawaiʻi’s working families

Outside of the top 5 percent richest households, families will likely see significant tax increases, while the cost of consumer items would spike under proposed tariffs.

Census poverty data for 2023 highlights the importance of government assistance

Promising trends for families across the nation, but many continue to feel the lasting effects of widespread unemployment during the pandemic, a rising cost of living, and inadequate government assistance.