Hawaiʻi’s two-tier tax system: How the rich use a glaring loophole to pay less

While teachers, nurses and service workers pay income tax on every dollar they earn, the wealthy can shield a large portion of their profits thanks to a special tax break on capital gains.

Youth Ride Free: Building a more connected Hawaiʻi

By removing financial barriers to public transit, Hawaiʻi can empower young people to participate fully in their communities, while easing family costs and supporting climate goals.

Transformative change meets budget realities—a central lawmaking tension plays out in two new reports

Policy in Perspective 2025 and the Hawaiʻi Budget Primer FY2025–26 provide a compelling—and sometimes sobering—look at how Hawaiʻi invests, and often under-invests, in its communities.

Powered by the people: How Hawaiʻi Appleseed’s community-first focus can create change—with your help

When we put people first, it means our policy proposals come from the community—which is essential to turning those proposals into law.

Federal transportation cuts threaten Hawaiʻi’s health and climate goals

With $131 million in transportation funds at risk, Hawaiʻi faces the possibility of lasting harm to our island infrastructure, and inhibited mobility for residents who rely on walking, biking and public transit.

How looming Federal cuts could impact housing in Hawaiʻi

If enacted, these cuts would gut rental assistance, eliminate key affordable housing development programs and slash funding for homelessness services.

Hawaiʻi families deserve better: How federal cuts to nutrition programs will impact our state

With grocery prices still soaring and food insecurity on the rise, this is the worst possible time to shrink our nation's most important anti-hunger program.

For a healthier, happier Hawaiʻi, transportation spending must prioritize bicycle and pedestrian infrastructure

Investing in the Safe Routes to School fund is a critical step in transforming our transportation system to meet the needs of all residents—pedestrians, cyclists and drivers alike.

Hawaiʻi’s 2025 legislature focused on raising tax revenue to prepare for federal cuts

Assessing a proper tax rate on corporations and the wealthy will be necessary to produce a budget that can fund critical safety net programs and investments in our future.

Transformative housing bills went nowhere this legislative session, but small wins keep hope alive

With federal cuts looming and home prices still climbing, the stakes have never been higher. One thing is clear: Hawaiʻi’s families can’t afford another session of half-measures.

Building a better path to success for Hawaiʻiʻs Keiki

Hawaiʻi’s 2025 legislature boosts safe routes to school and student transportation.

Wins for food access and low-income families at the 2025 legislative session

While there’s still more work to be done, this year’s wins have laid the groundwork for a future in which food access is treated as a right, not a privilege.

Two truths in tension: Hawaiʻi’s housing crisis and the urgent need for anti-displacement measures

We should reject the false choice between growth and protection, we can do both. Anti-displacement policies like HB1325 ensure that, as we build for the future, we don’t abandon our present.

Invest in Safe Routes to School to improve pedestrian safety in Hawaiʻi

Federal funding freezes, requirements from the Navahine lawsuit settlement, and worsening traffic and its associated negative impacts—why state lawmakers shouldn't wait to invest in Safe Routes to School.

Hawaiʻi’s keiki are still waiting for universal free school meals. The time to act is now.

Research shows that consistent access to nutritious meals improves both academic performance and long-term health. Yet, in 2023, 6 percent of Hawaiʻi households with children had one or more children go a whole day without food.

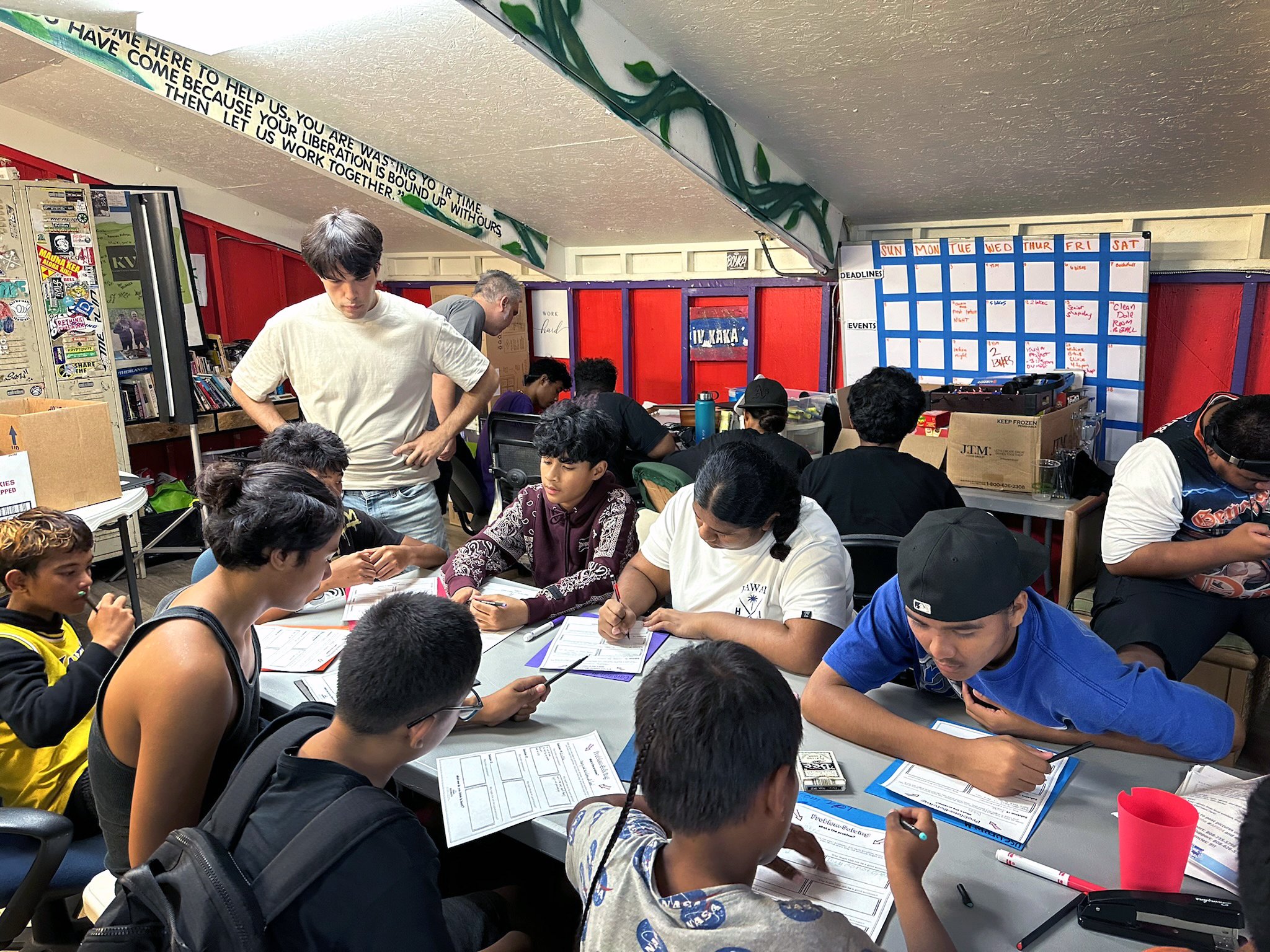

Empowering Kalihi’s youth leaders through community organizing and policy advocacy training

While people in power sometimes hand wave the voice of youth in policy conversations, our partnership with KVIBE is a reminder that young people can and should be integral components of the decision-making process.

Lawmakers still need to equitably raise revenue to meet Hawaiʻi’s needs

On tax policy, state legislators made progress in 2023 with tax relief, but left smart, revenue-raising policy initiatives on the table for next session.

A Hawaiʻi Child Tax Credit would keep thousands of keiki out of poverty

After the expiration of the expanded federal Child Tax Credit, poverty rates spiked—it’s time for Hawaiʻi lawmakers to step up and fill the gap.

Hawaiʻi inequality is on the rise—wealth taxes can help fix the problem

Hawaiʻi is one of the most unequal states in the nation for wealth distribution, but tax policy changes can help capture more wealth at the top to invest back into communities.

Community-driven progress on Hawaiʻi’s affordable housing crisis

The only to address Hawai‘i’s long-standing housing crisis is through a comprehensive, community- and data-driven approach designed not to just build more housing, but to build the housing that Hawaiʻi residents need and can afford.